About Sense bot

A general overview of what algorithmic trading is and what SenseBot does.

Concept

In a world where nearly everyone has access to algorithmic trading technologies, we're trying to make learning and experimenting more accessible.

Simple

Sense bot is designed to look more like your favorite social media platform than your typical brokerage site. We try to make navigation easy for people of all backgrounds so that users feel empowered, not overwhelmed.

Transparent

No degree in finance? No problem! At Sense we try to provide information in terms that everyone can understand. The core concepts to our platform are not that difficult, so we want to eliminate the tricky syntax.

Fun

Playing with money is fun, especially when you aren't risking your savings. By simplifying the experience, we're making it fun to test out your ideas and grow your financial literacy.

What is algorithmic trading?

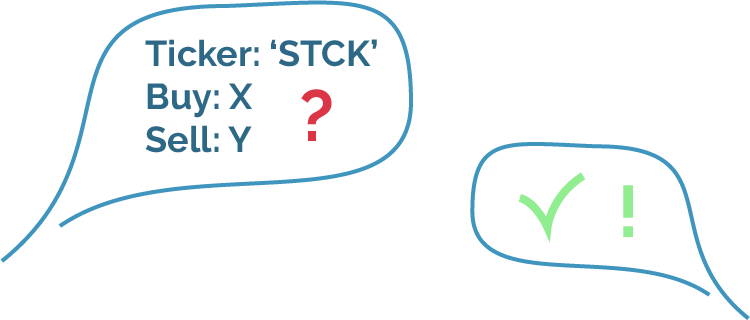

Algorithmic trading uses a computer program that follows a set of instructions (an algorithm) to place a trade.

The defined sets of instructions are based on timing, price, quantity, or any mathematical model. Apart from profit opportunities for the trader, algo-trading renders markets more liquid and trading more systematic by ruling out the impact of human emotions on trading activities.

Uses

Building models

With nearly instant feedback, you can quickly adjust your models to iron out problems and optimize profits.

Comparing stocks

A model that fails for one stock may be a raging success for another. Quickly apply models to different stocks to explore different performance across entire industries.

Find help

Post to the boards to see if others have ideas that can take your model to the next level.

Limitations

As with any financial analysis tool, SenseBot isn't perfect. Calculations are based on educated estimates of bid/ask availability. As a result, we cannot predict exactly how the stock would have performed, but we can get pretty close!